Warning

This article and series is specifically targeted for anyone involved or interested in oil and gas reserves reporting guidelines, methods, issues, calculations and pitfalls. Proceed at your own risk!

Introduction

In conventional hydrocarbon-bearing reservoirs, single well completions in an oil or gas accumulation often creates significant reserve booking issues, particularly for SEC reports. For this discussion, let’s assume a single well producing from one reservoir in a fault block. The only other well penetration in this accumulation is a well that is far downdip and the well log shows water to the top of the sand. The well has been producing oil at a constant rate for only a few weeks at commercial rates, so a performance-based estimate is not possible. Volumetric assessments of the in-place volumes can be accomplished, but what volume is appropriate?

Let’s Lay Out the Rules

Similar to the Ringfence subject discussed previously, the SPE/PRMS framework provides a bit more flexibility to the reserve evaluator regarding booking reserves in a fault trap with limited knowledge on oil, gas or water contacts. But the fundamental requirements remain the same for both sets of guidelines. The SEC’s rules on the subject are as follows, first regarding the lower limit where it is specified that “In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty.” (Reg S-X 210.4-10 (a)(22)(ii)). To paraphrase, the SEC requires corroborative data AND “reliable technology” arguments to use a lower contact than the lowest known oil in our example well. Likewise for counting volumes above the well penetration, the SEC states that “Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty.” (Reg S-X 210-4-10 (a)(22)(iii)). Thus, the requirements are like the downdip limit in order to estimate that the updip volume also contains oil, rather than an associated gas cap.

Volumes above the Highest Known Oil

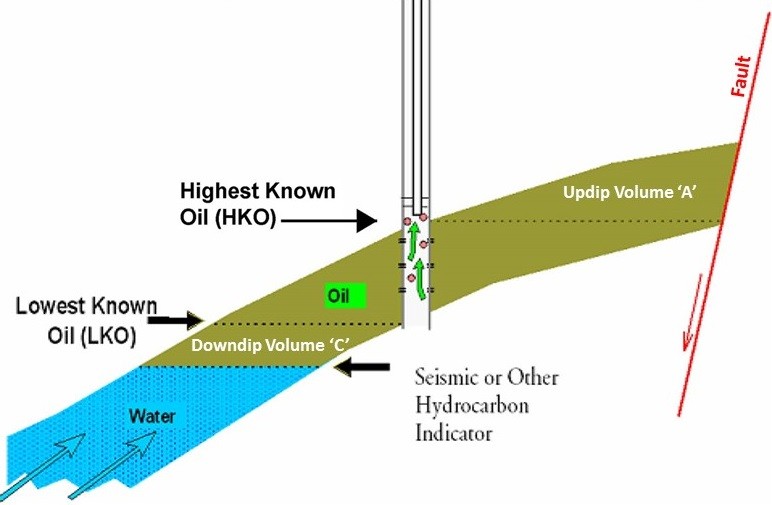

A cross section of our example well is provided in Figure 1. Without any other data, it would be difficult to book the volumes above the well completion as oil (Fig 1 – Updip Volume ‘A’). Of course, those volumes can be booked as gas based on the physics of fluid densities, but oil is preferred. It is always best to gather ALL the available data to determine the most likely answer. So what other data might exist to build the case for up-structure oil? Consider the following:

1. Is there any PVT data that could demonstrate the oil to be undersaturated with gas? Associated gas caps typically require the oil column to be fully saturated.

2. What is the GOR being produced? Is it rising or falling? From this data we might infer that the oil is undersaturated (though the data quality itself often makes this assertion difficult). A low GOR also could imply that any gas/oil contact is at least not immediately above the completion or it would be coning more gas.

3. Are there any analogous reservoirs in the area? Are gas caps common or not common?

Figure 1 – Single Well Penetration Schematic

Volumes below the Lowest Known Oil

The volumes below the Lowest Known Oil in our example are labeled “Downdip Volume ‘C’ in Figure 1. Again, all the available data should be gathered for analysis. So what other data might exist to build the case for down-structure oil? Consider the following:

1. Is there any seismic data that indicates reservoir limits, such as amplitude bright spots?

2. Do I have MDT pressures in the producing well, and in the downdip wet well (not shown)? If so, can I estimate an oil/water contact based on pressure gradients?

3. If I don’t have enough pressure data to establish a pressure gradient, do I have fluid density data to estimate a gradient based on density? Do I have gradient data from analogous reservoirs?

4. What is the water/oil ratio being produced? Is it rising or falling? Similar, but not as reliable as GOR trends, we might at least conclude that the water contact is not immediately below our completion (assuming the well was completed to the base of sand).

5. Does the fault mapping suggest a downdip spill point?

What Qualifies as Reliable Technology?

There are NO technologies that are pre-approved or given any blanket acceptance by the SEC; though this question comes up often. It is the responsibility of the evaluator to demonstrate that a technology is reliable. So regardless of the data available or used, you must be able to provide “Analogous Reservoirs” that have demonstrated the technology to be predictive and reliable. The SEC has specific definitions of Analogous Reservoirs as does the SPE/PRMS. It is best (though not required) that the analogous reservoirs be located in the same field/block, or an immediately adjacent property.

How Much Data/Evidence is Enough?

Unfortunately, there is no given prescription for exactly what is needed. Every reserve estimate is unique. This is where there is no substitute for expertise and knowledgeable evaluators that have had similar types of evaluations cross-checked by other partners, banks, courts and/or the SEC. But it’s safe to say that the more corroborative evidence that can be provided, the more likely that estimates will survive scrutiny. This is an area where experienced third-party consultants can be extremely valuable if this type of experience is not available within an organization.

Closing

The above example is very simple for discussion purposes, but the complexities in faulted reservoirs can present so many challenges to the evaluator. A single Gulf Coast salt dome structure can have dozens of hydrocarbon-bearing fault-trap reservoirs with limited data on oil, gas and water contacts. There is plenty of great literature available online to learn more about this, but please reach out to us if you want to discuss a specific situation. Thanks for reading!

Contact CG&A about Reserves: reserves@cgaus.com

Check Out Our Website: www.cgaus.com

Special thanks to @Jeffrey Wilson PE, @Jonathan Schmit, PE, @Heather Anderson, P.G. and @Shelby Loskorn for their efforts in publishing this series.